Because of the FLSA ruling, I have been asking my clients the same questions repeatedly.

- Do you have employees who are currently on salary?

- Is their salary less than $58,656 annually?

- What are their job duties and title?

- Do you know about the new DOL (Department of Labor) Overtime ruling?

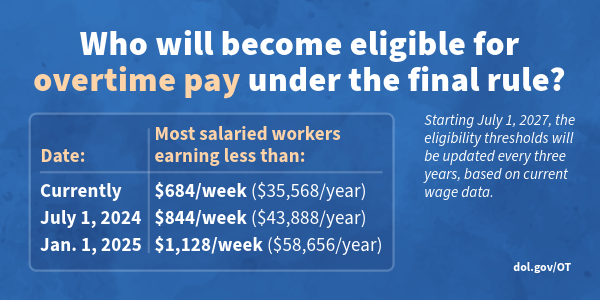

What new ruling you ask? Last week the Fair Labor Standard Act (FLSA) increased the required annual salary-level threshold by 23.4%.

If you are reading this and saying “Huh?” Or if you have no clue if this applies to you. Or if you want to understand the changes you need to make with your workforce – keep reading. I am going to try and simplify it as much as I can.[1]

Who needs to comply?

- The FLSA regulates essentially every employer which means everyone must comply with the changes.

What are the changes?

- Effective July 1, 2024, workers who earn less than $43,888 (the minimum salary requirement) will need their employment status classified as a non-exempt employee.

- Non-exempt means they qualify for overtime pay.

- Effective January 1, 2025, workers who earn less than $58,656 (the minimum salary requirement) will need their employment status classified as a non-exempt employee and are eligible for overtime.

- The next update will take place on July 1, 2027, and the salary threshold will increase again at that time.

Things to consider:

- Many employers think because they pay their employee on salary, the employee is exempt or ineligible for overtime pay. That isn’t an accurate statement.

- You can continue to pay your employees a salary provided they are reclassified as non-exempt they receive overtime pay whenever they work more than 40 hours in a workweek.

- Simply raising your worker’s salary to the new limit will not necessarily meet the classification requirements.

- Simply changing the employee’s title to “manager” or “supervisor” will not meet the new classification requirements.

What do I mean by that?

In addition to meeting the minimum salary requirement a position must meet certain “specific duties tests.” There are DOL websites where you can run the duties through and see if they qualify for an exception. I will summarize what I see the most of below.

Positions NOT eligible for salary or exemptions from the new rule.

In other words, if you are currently paying these employees on salary, you will need to classify them as non-exempt them by July 1st and they qualify for overtime pay.

- Blue collar workers or manual laborers. These employees perform work involving “repetitive operations with their hands, physical skill and energy.”

- Inside sales employees.

- Paralegals and legal assistants.

- Most admin assistants.

There are several “white collar exceptions.” Here are the two I mostly see with my clients.

Executives:

- The primary duty must be “managing the enterprise or managing a customarily recognized department.”

- Must regularly direct the work of at least 2 or more other full-time employees.

- Must have the authority to hire or fire other employees.

Administrative Workers:

- The primary duty must be “the performance of office or nonmanual work directly related to the management or general business operations.”

- The primary duty includes “independent judgment with respect to matters of significance.”

There is near certainty of legal challenges for this DOL ruling, but that doesn’t mean you shouldn’t comply. This is not a “let’s wait and see” situation. If you do not comply with the new requirements, be prepared to pay hefty penalties. It isn’t worth jeopardizing your business. I recommend you begin these changes sooner rather than later and be ahead of the game.

Here at Structure for Success we are happy to help you with assessing your workforce. Please reach out and let’s see how we can help.

Additional resources:

Businesses Face a Choice on How to Address DOL Overtime Rule Change (shrm.org)

DOL Releases Final Overtime Exemptions Rule | SPARK Blog | ADP

FAQs: FLSA Overtime (adpinfo.com)

[1] This article is strictly a summary of the new ruling. For detailed or personalized information, please reach out to me directly.