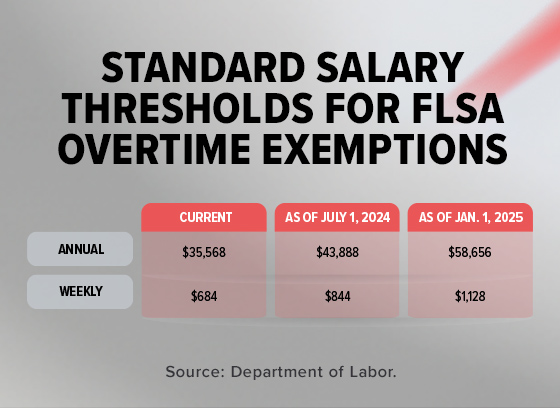

As we approach 2025, significant changes are on the horizon for employers and employees alike. The U.S. Department of Labor (DOL) has finalized a rule that will substantially increase the salary thresholds for overtime exemptions under the Fair Labor Standards Act (FLSA).

Here’s a brief overview of what this means for your business.

Key Changes Effective January 1, 2025

Impact on Employers

This change will require employers to potentially reclassify employees who were previously exempt from overtime pay. You will need to decide, as a business owner, whether to increase salaries to meet the new threshold or to reclassify affected employees as non-exempt, making them eligible for overtime pay.

Preparing for the Transition

To prepare for this transition, employers should:

- Review Current Salaries: Identify employees who are currently classified as exempt but earn below the new threshold.

- Evaluate Options: Decide whether to increase salaries to maintain exempt status or reclassify employees as non-exempt.

- Update Payroll Systems: Ensure that payroll systems are updated to comply with the new regulations.

- Communicate Changes: Clearly communicate any changes to affected employees to ensure a smooth transition.

Looking Ahead

The DOL has also announced that starting July 1, 2027, salary thresholds will be updated every three years based on current wage data1. This means that as your HR Consultant, we will working hard to stay informed about future adjustments to remain compliant.

Why am I bringing this to your attention in October? Because being proactive and addressing this now, before the holiday season starts, means your 2025 will be off to a smooth start.